American Income Life Things To Know Before You Buy

Wiki Article

The 8-Second Trick For Term Life Insurance Louisville

Table of ContentsUnknown Facts About Life Insurance Companies Near MeFacts About Life Insurance Online RevealedAbout Kentucky Farm BureauKentucky Farm Bureau Fundamentals ExplainedLife Insurance - Truths

1 Definitions as well as Kinds of Insurance Coverage Learning Purposes Know the fundamental types of insurance policy for individuals. Name and also define the different kinds of service insurance. An agreement of reimbursement.The person or company insured by an agreement of insurance policy. (often called the ensured) is the one who gets the repayment, except in the case of life insurance policy, where settlement goes to the recipient named in the life insurance contract.

The 30-Second Trick For Kentucky Farm Bureau

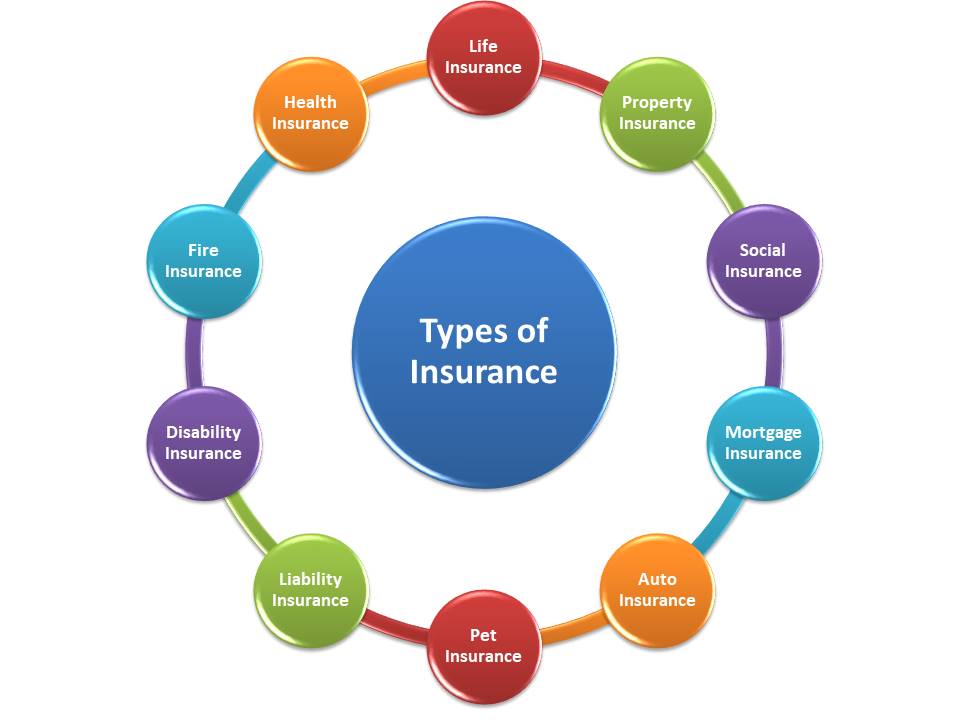

Every state now has an insurance policy department that looks after insurance policy rates, plan requirements, reserves, and other facets of the market. Over the years, these divisions have come under attack in several states for being inefficient and also "hostages" of the market. Large insurers operate in all states, and both they as well as customers must contend with fifty different state regulative plans that give really different levels of protection (Senior whole life insurance).We begin with an introduction of the sorts of insurance policy, from both a customer and a service point of view. Then we check out in greater detail the three most crucial kinds of insurance: home, responsibility, as well as life. Public and also Private Insurance Occasionally a difference is made between public as well as exclusive insurance. Public (or social) insurance coverage consists of Social Security, Medicare, temporary handicap insurance, and also the like, moneyed via federal government strategies.

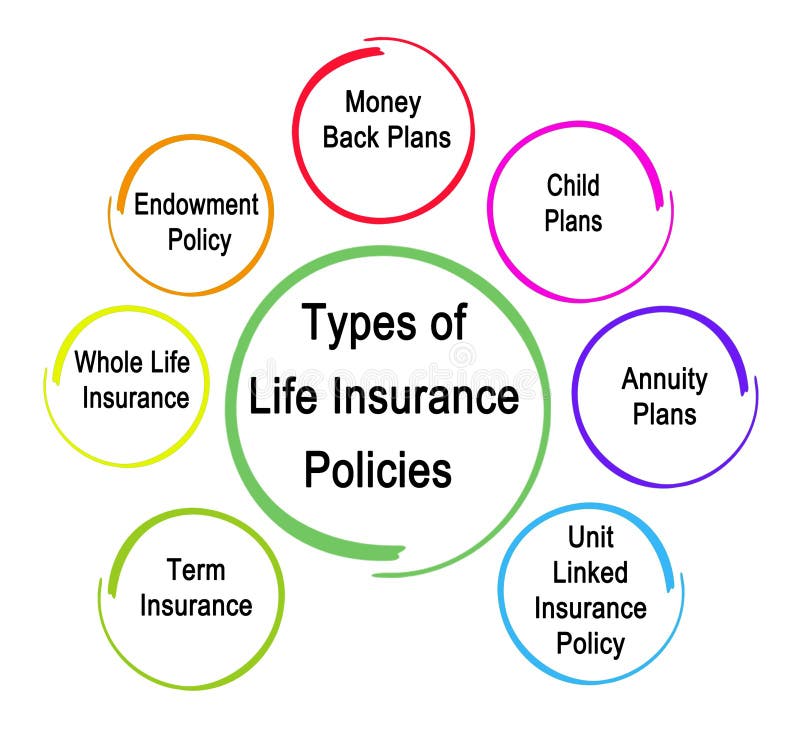

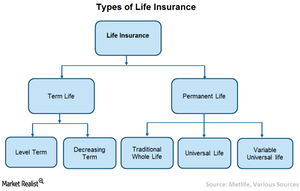

The emphasis of this phase is private insurance. Kinds of Insurance Policy for the Individual Life Insurance Policy Life insurance policy provides for your family or a few other named beneficiaries on your fatality. Two general kinds are readily available: term insuranceLife insurance with a death advantage however no accumulated cost savings. offers protection just throughout the regard to the plan as well as pays off just on the insured's death; whole-life insurance policyGives cost savings along with insurance policy as well as can let the insured collect before death.

The 3-Minute Rule for Whole Life Insurance

Health Insurance policy Medical insurance covers the expense of a hospital stay, check outs to the medical professional's office, as well as prescription medicines. Senior whole life insurance. The most helpful plans, supplied by several employers, are those that cover one hundred percent of the costs of being hospitalized as well as 80 percent of the costs for medicine and a physician's solutions. Normally, the plan will consist of a deductible amount; the insurance company will certainly not make settlements until after the insurance deductible quantity has actually been gotten to.

Handicap Insurance A disability plan pays a certain percentage of a worker's wages (or a dealt with sum) weekly or regular monthly if the staff member comes to be incapable to function with health problem or a mishap. Premiums are reduced for policies with longer waiting periods before payments should be made: a plan that begins to pay a handicapped employee within thirty days may cost two times as high as one that defers repayment for 6 months.

The Single Strategy To Use For Life Insurance Quote Online

Auto Insurance policy Automobile insurance policy is maybe one of the most typically held kind of insurance - Life insurance company. Auto policies are called for in at least minimal amounts in all states. The common car policy covers responsibility for physical injury and also building damages, medical settlements, damage to or loss of the cars and truck itself, and also lawyers' charges in situation of a suit.An individual obligation plan covers many types of these risks and can provide protection in extra of that given by property owner's and also automobile insurance policy. Such umbrella protection is generally rather inexpensive, probably $250 a year for $1 million in responsibility. Sorts Of Business Insurance Employees' Payment Nearly every business in every state have to guarantee against injury to employees on the job.

Fascination About Term Life Insurance Louisville

Negligence Insurance Coverage Professionals such as doctors, attorneys, as well as accounting professionals will certainly typically purchase negligence insurance to secure versus insurance claims made by unhappy individuals or clients. For doctors, the expense of such insurance policy has been rising over the previous thirty years, mostly because of larger jury honors against medical professionals who are irresponsible in the method of their profession.Responsibility Insurance policy Organizations deal with a host of risks that might lead to significant liabilities. Many kinds of plans are available, consisting of plans for owners, property managers, and renters (covering obligation sustained on the properties); for makers and service providers (for responsibility incurred on all facilities); for a business's products and also finished operations (for obligation that arises from guarantees on items or injuries created by items); for owners as well as service providers use this link (protective liability for damages brought on by independent service providers engaged by the guaranteed); and for contractual obligation (for failure to follow efficiencies required by specific contracts) (Whole life insurance Louisville).

Today, the majority of insurance policy is readily available on a plan basis, with solitary policies that cover the most essential threats. These are typically called multiperil plans. Key Takeaway Although insurance is a requirement for every United States service, as well as lots of services run in all fifty states, guideline of insurance policy has actually stayed at the state degree.

Report this wiki page